If you’ve built up equity in your home, tapping into it through a home equity loan (or a home equity line of credit, HELOC) can be an attractive way to access cash for renovations, debt consolidation, or major life expenses. But how much equity can I get from my home? In Canada, the answer depends on a few key variables: your home’s value, how much mortgage you still owe, and lender/regulatory limits. Below, we break it down and also show how Equity Rich’s custom solutions might fit.

How Is Home Equity Determined, and What Does It Mean?

Your home equity is simply:

Home equity = Current market value of home – Outstanding mortgage balances (and other secured liens)

For example, if your home is worth CAD $600,000 and you owe CAD $300,000 on your mortgage, your equity is $300,000. However, just because you have that $300,000 in equity doesn’t mean you can borrow it all. Lenders impose limits for risk management.

Typical Borrowing Limits in Canada

HELOCs (Home Equity Lines of Credit)

- For federally regulated lenders, the typical maximum borrowing against home equity via a HELOC is up to 65% of your home’s appraised value.

- That means if your home is appraised at $600,000, you may be eligible to borrow a revolving credit of up to $390,000 (65%) in total, minus any outstanding mortgage.

- Note: Some banks offer special products where a portion can go beyond 65% if structured as a fixed-term “term portion.” For example, TD’s Home Equity FlexLine may allow up to 80% in blended structures under certain conditions.

- However, recent regulator and lender tightening has reinforced the 65% cap for many HELOCs, especially with federally regulated lenders.

Home Equity Loans / Second Mortgages / Cash-Out Mortgages

When you access equity through a home equity loan, second mortgage, or cash-out refinance, lenders assess your loan-to-value (LTV), the total mortgage amount registered on the title after funding, divided by the home’s appraised value.

- Refinance / Home-equity loan cap: Most Canadian lenders allow up to 80% LTV for refinances/equity take-outs.

- HELOC note: Revolving HELOC portions are generally capped at 65% LTV; some lenders allow the overall exposure up to 80% LTV only if any amount above 65% is put into a fixed, amortizing term portion.

- Purchase context (for comparison): On new purchases, LTV can be up to 95% with mortgage insurance (i.e., minimum 5% down). Between 80% and 95% LTV, insurance is required.

Example (refinance or adding a second):

- Appraised value: $600,000

- 80% LTV ceiling: $480,000

- Current first-mortgage balance: $300,000

- Maximum additional equity available ≈ $180,000 (before fees), either by refinancing the first to $480,000 or by adding a second mortgage so that total mortgages on the title remain ≤ 80% LTV.

How Much Can I Borrow “Against My House” in Canada?

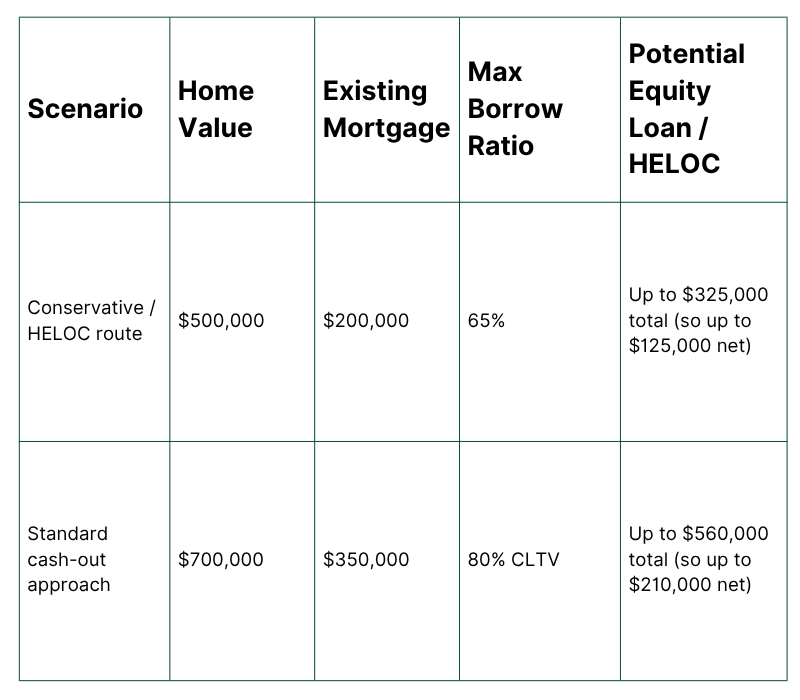

Let’s run a few example scenarios to illustrate how much equity you can borrow in Canada.

Of course, your actual borrowing limit might be lower because lenders will also consider:

- Your credit score (Also check out: What Factors Do Mortgage Lenders Consider When Working with Low-Credit Borrowers?)

- Your income and debt servicing ability

- Your debt-to-income ratio

- The province (some lenders have regional policies)

- Any existing liens or second mortgages

Reverse Mortgages & Older Homeowners

If you’re 55 or older and want to tap home equity without making mortgage payments, a reverse mortgage is an option. In Canada:

- Reverse mortgages generally allow up to 55% of your home’s value to be borrowed.

- The loan is repaid when you move or pass away (or under certain conditions).

- It’s not suitable for everyone because interest accrues and reduces your remaining equity.

Why You Might Not Get the Maximum

Even though the theoretical caps exist, many borrowers won’t qualify for the full amount. Here’s why:

- Your credit history or score may disqualify you from aggressive lending

- Debt obligations (car loans, credit cards) may limit how much new debt you can carry

- Lenders often leave a margin for safety, not front all available equity

- Some municipalities or local lenders impose regional caps

- For self-employed or low-doc borrowers, lenders may reduce the allowable amount or increase the rate.

If you’re in a difficult income situation, you might explore no-income mortgage options (though these tend to carry high risk and rates).

How Equity Rich’s Custom Solution Can Help

This is where Equity Rich offers value. Rather than relying solely on standard HELOC or second-mortgage products, Equity Rich builds a custom solution based on:

- Your affordability (income, expense ratio)

- Your property value and existing debt

- Your goals (renovation, debt consolidation, cash flow)

Because Equity Rich is not constrained to rigid banking products, we can help you tap more of your equity safely by tailoring structures (term portions, staggered draws, and blended rate strategies). If a standard lender caps you at 65%, Equity Rich might structure a hybrid that gives you more flexibility.

Tips for Borrowing Wisely

- Don’t Max Out Your Equity: Leave a buffer for unexpected market declines.

- Shop Interest Rates Carefully: Second mortgage/equity products often come with higher rates.

- Understand Repayment Terms: HELOCs often have variable rates and periodic interest-only periods.

- Watch For Fees And Closing Costs: Appraisals, legal fees, and discharge fees.

- Plan for Rate Increases: if it’s variable, rates may rise. If you’re self-employed, gather strong documentation, such as several years of business income, clear statements, etc. Check out mortgages for the self-employed.

- If income is irregular, a more conservative borrowing amount may protect you

Summary & Takeaways

- In Canada, you can typically borrow up to 65% of your home’s value through a HELOC (minus any existing mortgage balance) or up to 80% LTV through a home equity loan or cash-out refinance.

- Real-world limits are lower due to income, credit, and lender policies.

- For seniors, reverse mortgages allow up to 55% of the value.

- Equity Rich provides tailored solutions that may give you more flexibility beyond conventional products.

- Always evaluate your full affordability, not just how much you can borrow. Opt for our mortgage services in Canada.

Also check: Can Debt Consolidation Help with Student Loans in Toronto?