In Canada, traditional banking institutions have long been the go-to choice for securing mortgages. However, in recent years, private lenders have begun to fill the gaps that big banks leave behind, offering flexibility, speed, and tailored solutions for those who may not fit within the strict requirements of a bank loan.

With an increasing number of Canadians turning to private lenders, it’s crucial to understand how they operate and why more people are considering them as a viable alternative to traditional bank mortgages.

Private Lenders vs. Banks: What’s the Difference?

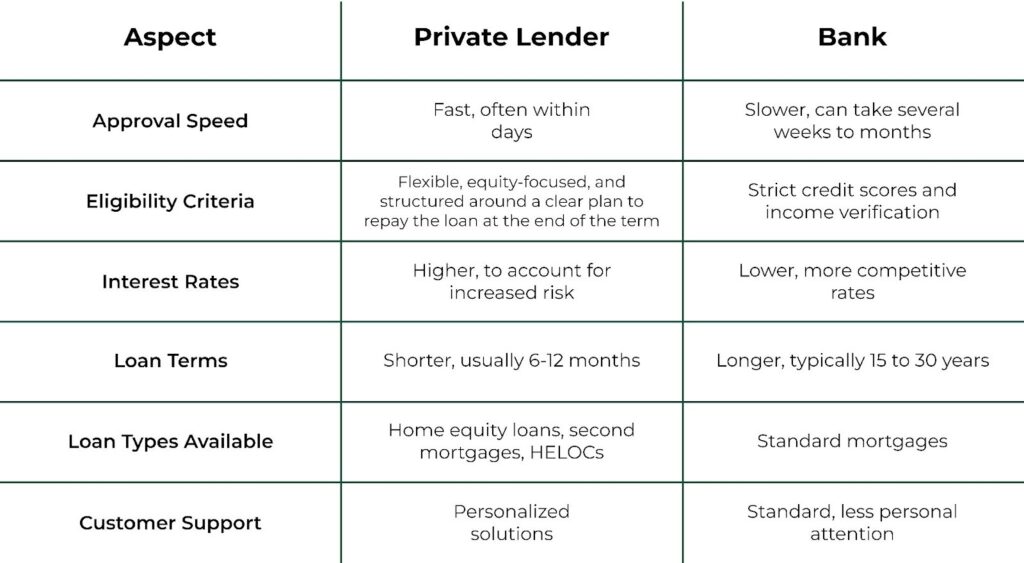

The primary distinction between private lenders and banks lies in their lending criteria. While banks follow strict guidelines set by the government and regulatory bodies, private lenders are more flexible. They focus more on the equity in a property and the borrower’s ability to repay, rather than credit scores, employment history, or other traditional factors that banks often prioritize.

Private Mortgage Lender vs. Bank

Banks generally require a strong credit score, verifiable income, and a significant down payment. However, private lenders tend to take a more holistic view of the property and the borrower’s situation, which can be especially beneficial for those with poor credit or irregular income sources.

Why Consider Private Mortgage Lenders?

There are several reasons why Canadians are increasingly looking at private mortgage lenders, especially those who fall into non-traditional categories. Here are the key benefits and potential drawbacks of choosing a private mortgage lender:

Pros of Choosing a Private Lender

- Flexibility in Criteria

Private lenders are generally more lenient with their eligibility requirements. For example, if you’re self-employed, have a lower credit score, or are looking for a mortgage in a non-traditional situation (such as an unconventional property type), a private lender may offer a more customized solution.

Also check out: What Factors Do Mortgage Lenders Consider When Working with Low-Credit Borrowers?

- Speed of Approval

Private lenders tend to offer faster approval processes, often closing mortgages within a matter of weeks. This can be a game-changer for those needing quick financing, whether for a home purchase or a refinance. - Home Equity Loans and HELOCs

Private lenders often specialize in offering home equity loans and home equity lines of credit (HELOCs). This can be an excellent option for homeowners who have substantial equity in their properties but may not meet the stringent criteria set by banks. - Alternative Lending Solutions

For individuals who don’t fit the traditional mould (for example, retirees looking to unlock home equity in retirement or those with a non-conventional income source), private lenders can offer a viable solution to secure financing. A second mortgage or reverse mortgage can be beneficial in these situations, providing more flexible options than a bank might be willing to offer.

Cons of Choosing a Private Lender

- Higher Interest Rates

The main downside of working with a private lender is the typically higher interest rates. Since private lenders are taking on more risk due to the relaxed eligibility criteria, they often charge higher rates compared to traditional banks. - Shorter Terms

Private mortgages often come with shorter terms than those offered by banks. This can be beneficial in some situations, but it could create challenges for borrowers looking for long-term stability. - Lack of Government Regulation

Unlike banks, which are regulated by government agencies, private lenders operate with less oversight. While this offers flexibility, it also means that borrowers should be extra diligent in reviewing the terms of the loan. Another risk is that if property values drop significantly, the lender may choose not to renew the loan and may require the balance to be repaid.

Is It Better to Get a Mortgage with Private Lenders?

Whether it’s better to choose a private lender over a bank depends on your individual circumstances. If you have strong credit, a stable income, and are looking for the best possible interest rate, a bank mortgage might be the best option for you. However, for those with less-than-ideal credit, irregular income, or non-traditional property types, private lenders provide an invaluable alternative.

Private Mortgage Lenders Are Filling the Gaps in the Canadian Market

The Canadian mortgage landscape is evolving, and private lenders are filling the gaps left by traditional banks. As more Canadians seek financing options that banks cannot provide, private lenders offer a vital service, ensuring that those who might otherwise be overlooked can still access the funds they need.

From home equity strategies to no-income mortgages, private lenders have become an essential part of the Canadian mortgage market. Whether you’re looking to boost your financial strategy with a second mortgage or need a mortgage solution with no income verification, a private lender may be the best way forward.

In conclusion, private mortgage lenders are an excellent choice for many Canadians, especially those who do not fit the traditional bank mould. With more flexible terms, faster approval processes, and tailored solutions, private lenders provide an essential service for equity-rich retirees, the self-employed, and those seeking non-traditional financing options. However, it’s essential to weigh the pros and cons, particularly when it comes to higher interest rates and shorter loan terms.

If you find yourself needing a private mortgage, home equity loan, or reverse mortgage, be sure to explore the mortgage services in Canada.