Retirement isn’t just about saving money; it’s also about making the most of what you currently have. The home is the single most valuable possession for many Canadians. A well-considered and planned use of home equity loans in retirement planning can assist in managing cash flow, lowering debt, paying for medical expenses, supporting children, or even making strategic investments. Yet, there is no one-size-fits-all solution; various home equity plans (such as HELOCs, reverse mortgages, downsizing, or mixed “re-advanceable” products) have varying expenses, hazards, and tax implications.

A useful guide on using your equity in Canada is provided here, along with information on recent changes, what is permitted, and when these tactics make sense in a retirement plan.

Quick Definitions

- Home Equity: Your home’s market value minus what you owe on it.

- HELOC (Home Equity Line of Credit): A revolving line secured by your home; you pay interest only on what you use.

- Re-Advanceable Mortgage (CLP): A mortgage bundled with a HELOC that increases as you pay down principal, now restricted by OSFI rules (details below).

- Reverse Mortgage: Allows homeowners 55+ to borrow against home equity with no required monthly payments; the loan plus interest is repaid when you sell, move out, or the estate settles. Canadians can typically access up to about 55% of the appraised value, depending on age and property.

Why Home Equity Matters More Now

- High Housing Wealth: Many households, especially older owners, are “house-rich” but cash-flow tight. In several Canadian cities, about 34% of homeowners are mortgage-free, indicating substantial untapped equity among older cohorts.

- Rate Environment: After two years of aggressive hikes, the Bank of Canada’s benchmark interest rate now sits at 2.50%, offering some relief to variable borrowers and making mortgages a retirement strategy more attractive for some.

- Growing Equity-Release Market: The reverse mortgage market in Canada has grown steadily in recent years, reflecting a shift in how retirees view their home equity. More Canadians aged 55 and older are turning to equity-release solutions to supplement their income, manage rising living costs, or fund home improvements without selling their homes.

The Main Ways To Use Home Equity In Retirement

1. HELOC (or re-advanceable HELOC) For Flexible Cash Flow

A HELOC lets you draw, repay, and redraw funds as needed. It’s common for emergency funds, home repairs, or bridging expenses.

As of late 2023, re-advanceable products are not re-advanceable above 65% loan-to-value (LTV). You can still borrow up to 80% LTV in total (mortgage + HELOC), but the revolving HELOC portion is capped at 65% LTV and may not automatically re-increase until you’re below that threshold. Lenders phased this in at renewal after Oct/Dec 2023 (depending on the fiscal year).

- Pros: Interest-only payments, flexible access, usually lower rates than unsecured credit.

- Cons: Rates are variable and linked to the Prime rate, meaning your monthly payments can rise or fall as the Prime rate changes.

Data Note: The Bank of Canada publishes HELOC statistics across chartered banks, useful for tracking utilization and rate trends over time.

2. Reverse Mortgage For No-Payment Borrowing (55+)

If cash flow is your main issue and you want to stay in your home, a reverse mortgage can turn equity into tax-free loan proceeds (loan interest accrues and is repaid later).

When it fits:

- You have significant equity and want to avoid monthly debt payments.

- You need to supplement the Canada Pension Plan (CPP) and Old Age Security (OAS) or cover care costs.

- You’d prefer not to sell, downsize, or take on tenants.

Costs/Risks:

- Higher interest rates than HELOCs; compounding increases the balance over time.

- Reduces estate value.

- You must maintain the home and keep taxes/insurance current.

Market Context: Canada’s reverse-mortgage balances have grown quickly, reaching multi-billion levels, a sign that more retirees are using them to unlock equity without selling.

You can also take a look at retirement mortgages.

3. Downsizing, Selling, Or A Blend

Sometimes the best “loan” is none at all: selling (or moving to a smaller/cheaper location) converts equity to cash that can be invested or used for care. A hybrid approach, a modest HELOC now, and a planned downsize later can balance lifestyle needs and market timing.

You can also access your equity with a no-income mortgage.

Can You Use Retirement Accounts To Buy A Home?

The common question we hear is, “Can I invest my pension in property?”

- Registered Retirement Savings Plan (RRSP): The Home Buyers’ Plan (HBP) now allows up to $60,000 per person (increased from $35,000 on April 16, 2024) to be withdrawn tax-free for a first home, with repayment required over time. Couples can withdraw up to $120,000 combined. This is one way of buying a house with retirement money while maintaining your long-term investment outlook.

- CPP/OAS “Pension” Benefits: You can’t directly “invest your CPP/OAS” into a house. These are income streams, not accounts you can draw down like an RRSP.

- First Home Savings Account (FHSA): Separate from this blog’s retirement focus, but you can use HBP and FHSA together for the same qualifying home if you meet both sets of conditions.

For retirees considering using registered funds to buy property later in life, review tax impacts (withholding, RRIF minimums at 71, etc.) and liquidity needs before deregistering assets.

“Mortgage As A Retirement Strategy”: When Does It Make Sense?

Carrying some mortgage (or a HELOC balance) into retirement can make sense if:

- The borrowing cost is lower than the expected after-tax, after-fee return on your investments and

- You have a stable, diversified income, a cushion for rate rises, and a clear repayment plan.

Rule of Thumb: Debt can be a tool, but in retirement, sequence-of-returns risk, health shocks, and rate volatility make leverage riskier. Keep buffers.

Using Home Equity To Invest (Stocks Or Property): Risks & Safeguards

A popular idea is borrowing on a HELOC and investing for higher returns (a version of the “Smith Manoeuvre”). Today, OSFI’s 65% LTV cap on re-advanceable HELOCs limits how quickly your credit limit grows as you pay down principal, which reduces leverage speed.

If you pursue this anyway:

- Stress-test your plan at higher interest rates and lower market returns.

- Automate payments; consider setting a maximum draw (e.g., never above 30–40% of available HELOC).

- Keep at least 12 months of interest costs in cash reserves. Mind tax (deductibility depends on direct, traceable use of borrowed funds to earn income; speak to a tax professional).

Using Home Equity To Invest In More Real Estate

To what extent should you invest in real estate during your retirement? Although real estate can be a reliable long-term investment, over-concentration raises risk due to vacancies, maintenance, and rate rises. Adding more property can hamper diversity because many retirees already have the majority of their net worth in their home. If you want real estate exposure without landlord risk, think about real estate investment trusts (REITs) or a well-balanced portfolio.

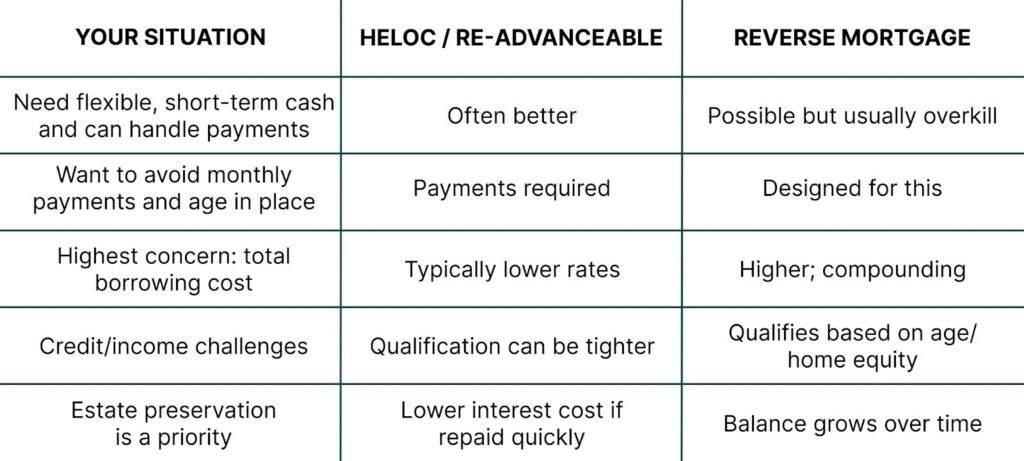

How to Choose Between HELOC and Reverse Mortgage

Tip: Ask lenders to model 3 scenarios (base, lower home price/higher rate, and longer borrowing period) so you can see drawdown and equity remaining over time.

Equity Rich offers an alternative, custom-built solution designed around each borrower’s needs, affordability, and long-term goals, helping you access your equity with confidence and clarity.

Practical steps before you borrow against your home

- Budget First: Map fixed expenses (property tax, insurance, utilities), healthcare, and discretionary spending.

- Stress Test: Can you still afford payments if rates rise 1–2 percentage points? Variable-rate sensitivity is real, even if cuts have begun.

- Check Product Rules: If you want a re-advanceable mortgage for investing, understand the 65% LTV cap and renewal timing.

- Compare Total Cost Of Capital: HELOC vs. reverse mortgage vs. downsizing — ask for annual percentage rate (APR) comparisons, not just headline rates.

- Tax and Benefits Check: How withdrawals/borrowing interact with Old Age Security (OAS) clawback, Guaranteed Income Supplement (GIS) eligibility, and RRIF minimums.

- Estate Conversation: Align borrowing with your estate goals; document expectations with family and your POA/executor.

Shop Lenders: Use published data (e.g., Bank of Canada) as context, then compare real quotes and fees.

Keep an emergency fund (6–12 months of expenses). Choose HELOCs for flexible, shorter-term, or planned projects; reverse mortgages when cash flow is the binding constraint and staying in your home is the priority. If you use home equity to invest, keep position sizes reasonable and diversify beyond real estate. Opt for our mortgage services in Canada to get the right fit.

FAQs

- Can you use your pension to buy a house?

Not directly with CPP/OAS. You can use RRSP funds via the Home Buyers’ Plan (up to $60,000 per person). - Is a mortgage a good retirement strategy?

Sometimes, it funds a durable lifestyle value, and your portfolio likely out-earns the after-tax borrowing cost. But given today’s higher debt loads and variable-rate sensitivity, many retirees prioritize lower fixed costs and liquidity. - How much of my retirement should be in real estate?

There’s no set percentage, but avoid concentration risk. If your home is already your largest asset, consider balancing with liquid, income-producing investments. - Can I combine a HELOC and a reverse mortgage?

You typically wouldn’t hold both at once. Many households try a HELOC first and pivot to a reverse mortgage if cash-flow strain appears.